The global economic trends are repeatedly unpredictable. One time the economy rises, while the other falls. In the center of the economy are companies that go bankrupt, either both external and internal economic reasons. Bankruptcy means disaster because the whole organisation collapses. However, bankruptcy need not be an unannounced catastrophe. There is a method to forecast bankruptcy and the way is known as the Altman Z-Score. The Altman Z-Score is a bankruptcy predicting tool.

The Altman Z-score is the output of a credit-strength test that gauges a publicly traded manufacturing company’s likelihood of bankruptcy. The Altman Z-score is based on five financial ratios that can be calculated from data found on a company’s annual 10K report. It uses profitability, leverage, liquidity, solvency and activity to predict whether a company has a high degree of probability of being insolvent.

Edward Altman, a Professor of Finance at New York University’s Stern School of Business, founded the ‘Z-Score’ formula to predict bankruptcy in 1968. At first, the Altman Z-Score was found to be 72% accurate in predicting bankruptcy two years prior to the bankruptcy. Over the time the accuracy of the Altman Z-Score improved with time, with 82-94% accurate result. Recently, Graham Secker, a strategy analyst with Morgan Stanley used the ‘Z-Score’ in 2009 to rank a group of European companies. He found that the companies with weaker balance sheets underperformed the market more than two-thirds of the time.

The Altman Z-Score serves a lot of essential purposes. Some of them are mentioned here:

- The Altman Z-Score ascertains credit ratings and probabilities in the short-term and long-term future and for both privately-held and publicly traded companies.

- The Altman Z-Score leads to robust and logical credit scoring, which is based on a significant sample of companies where their financial health or credit setbacks are analyzed and used as a predictive factor.

- The Altman Z-Score credit event prediction has high accuracy value as compared to other rating agency models.

Many stakeholders interested and use Altman Z-Score formula to determine the credit worthiness of a company as well as to determine credit risk. For instance, banks as a financial institution use Altman Z-Score to determine the risk of issuing loans to companies and firms. In the application, calculating the Altman Z-Score is simple and straightforward as everything is based on strong data.

In addition to that, turnaround managers and mergers and acquisition managers use the Altman Z-Score model to determine risks and develop strategies to alleviate the risks. Similarly, the insurance industry and the corporate governance departments use the scoring system for a variety of purposes.

The formula of Altman Score is as follows.

Altman Z-Score = 1.2*T1 + 1.4*T2 + 3.3*T3 + 0.6*T4 + 1.0*T5

Here are the key definitions from the above formula:

T1 = Working Capital / Total Assets

This ratio measures liquid assets. The companies in trouble will usually experience shrinking liquidity.

T2 = Retained Earnings / Total Assets

This ratio calculates the overall profitability of the company. Dwindling profitability is a warning sign.

T3 = Earnings before Interest and Taxes / Total Assets

This ratio shows how productive a company is in generating earnings, relative to its size.

T4 = Market Capitalization / Total Liabilities

This ratio suggests how far the company’s assets can decline before it becomes technically insolvent (i.e., its liabilities become higher than its assets).

T5 = Sales / Total Assets

This is the asset turnover ratio and is a measure of how effectively the firm uses its assets to generate sales.

http://sinovoltaics.com

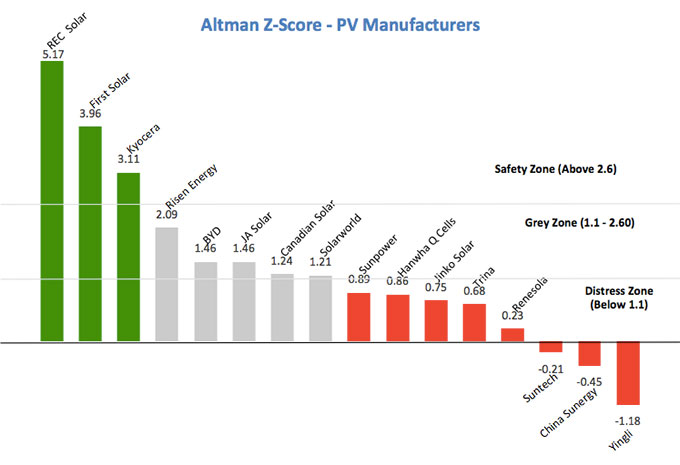

The result? If the Z Score is higher than 3.0, the company is a ‘safe’ company. If this score is less than 3.0, there is a high probability of the company going bankrupt.

In general, this Altman ratio is not applicable to all companies and applicable to only publicly listed and manufacturing companies.