Interested working closely related with calculating risk? The financial risk management is suitable for you. Financial risk management is the practice of economic value in a firm by using financial instruments to manage exposure to risk, includes Operational risk, credit risk and market risk, Foreign exchange risk, Shape risk, Volatility risk, Liquidity risk, Inflation risk, Business risk, Legal risk, Reputational risk, Sector risk etc. Similar to general risk management, financial risk management requires identifying its sources, measuring it, and plans to address them.

Financial Risk management (FRM) certification is needed for anyone who interested in working as financial risk manager. FRM is a specialized exam for obtaining expertise in Risk Management. FRM is suited for those who want to make a career in Risk management in Banks, Treasury Department or in Risk Assessments, as a Financial Risk Manager.

FRM (Certified Financial Risk Manager Program) is an international professional certification offered by GARP (The Global Association of Risk Professionals). GARP is the only recognized membership association for professional risk managers. GARP is a not-for-profit organization and aims at creating a cultural environment of risk awareness and management at every organizational level. The corporate headquarters of GARP is located in Jersey City, New Jersey with a regional office in London, England.

There are half a million members across 195 countries of the GARP. These institutions, namely central banks, commercial banks, investment banks, corporations, asset management firms, academic institutions and government agencies, employ the members of GARP.

- Top 10 global banks employing FRMs are Bank of America, Bank of China, ICBC, Agricultural Bank of China, HSBC, Wells Fargo, Citigroup, Banco Santander, JP Morgan Chase, China Construction Bank.

- Top 80 companies employing FRMs are Goldman Sachs, KPMG, Deloitte, PIMCO, JP Morgan, BlackRock, Morgan Stanley, Credit Suisse, Bridgewater Associates, Man Group, Barclays, ING, AIG

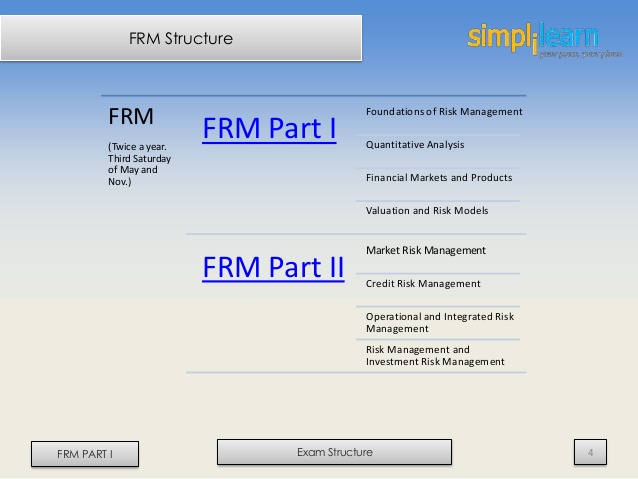

To obtain the certification, FRM exams are compulsory and it consists of 2 level of examination. The FRM Exam Part I includes the tools used to assess financial risks, such as Foundations of Risk Management, Quantitative Analysis, Financial Markets and Products, Valuation and Risk Models.

https://www.slideshare.net/stefanhenry/frm-part1-exam-structure

The FRM Exam Part II focuses on the application of the tools acquired in the FRM Exam Part I through a deeper exploration of Market Risk Measurement and Management, Credit Risk Measurement and Management, Operational and Integrated Risk Management, Risk Management and Investment Management, Current Issues in Financial Markets.

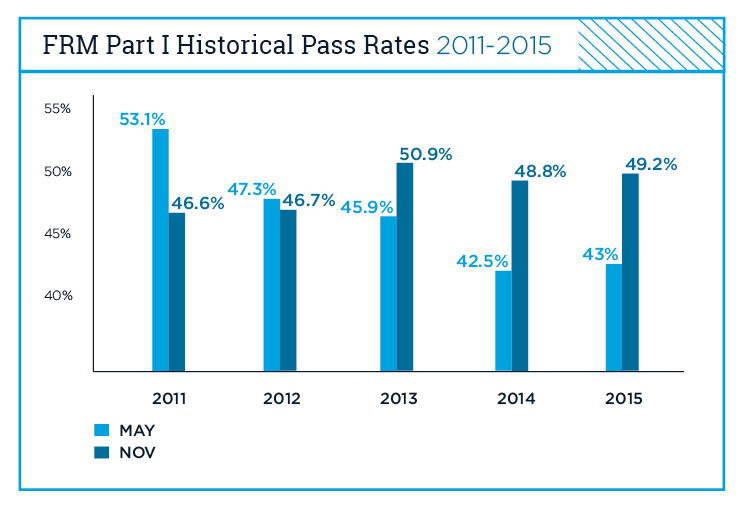

Successful candidates take an average of two years to earn their FRM Certification. The examination fee is between $1050-$1500. The exams both FRM I and FRM II are conducted twice a year and both can be taken at the same day at once. It is required around 150 hours of study for the examinations for each level. The rate of the historical pass of FRM exams is approximately 40%-50%.

http://www.garp.org/#!/frm/program-exams

The curriculum is updated yearly by a group of distinguished risk professionals employed internationally at nearly every major bank, asset management firm, hedge fund, consulting firm, and regulator in the world.

FRM test has a straight competition from PRM (Professional Risk Manager). If you want to make a career in Risk management, then you may want to choose between the two exams – FRM or PRM. In general, FRM is rather popular examination between the two and for a starting point, it makes sense to appear for FRM exam first.